PARADIGM

Elevating Document Management

Empowering Businesses with Intelligent Document Solutions

100% Japan Tax Reform & Invoice System Compliant

As a JIIMA Certified Document Management System, you can use Paradigm to securely store digital copies of your finance documents—leaving paper behind.

What is Paradigm?

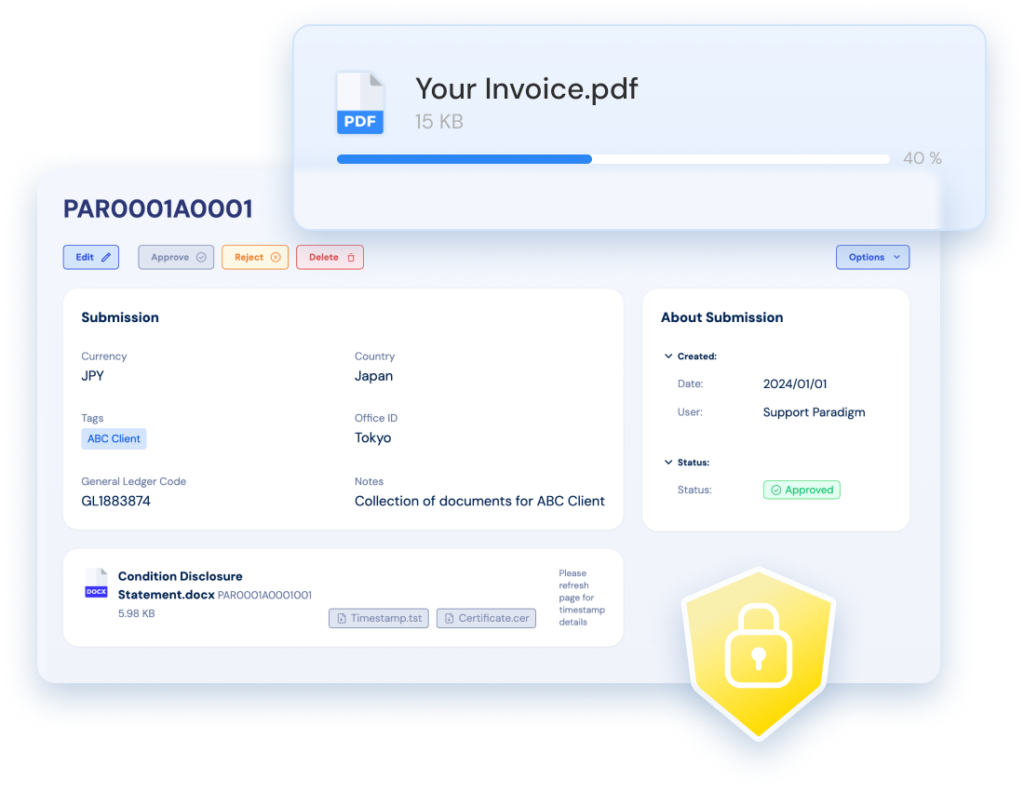

Paradigm is a Document Management platform designed to simplify regulatory processes without requiring technical expertise.

Its intuitive interface and automated workflows help businesses stay compliant effortlessly, reducing manual work and ensuring accuracy. With built-in security, Paradigm provides a seamless and reliable solution for finance and compliance teams.

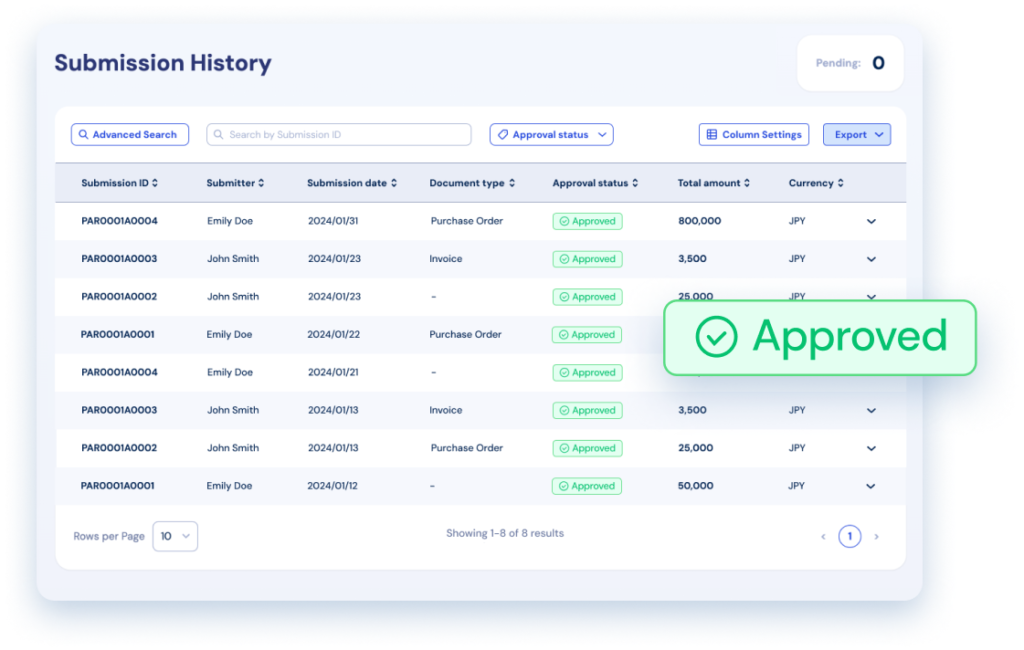

COMPLIANT

Paradigm ensures full compliance with Japan’s 2023 Tax Reform

Ensure seamless compliance with Japan’s National Taxation Agency regulations for both digital-to-digital and physical-to-digital document storage. Stay confidently aligned with current and evolving requirements, simplifying regulatory adherence for your business.

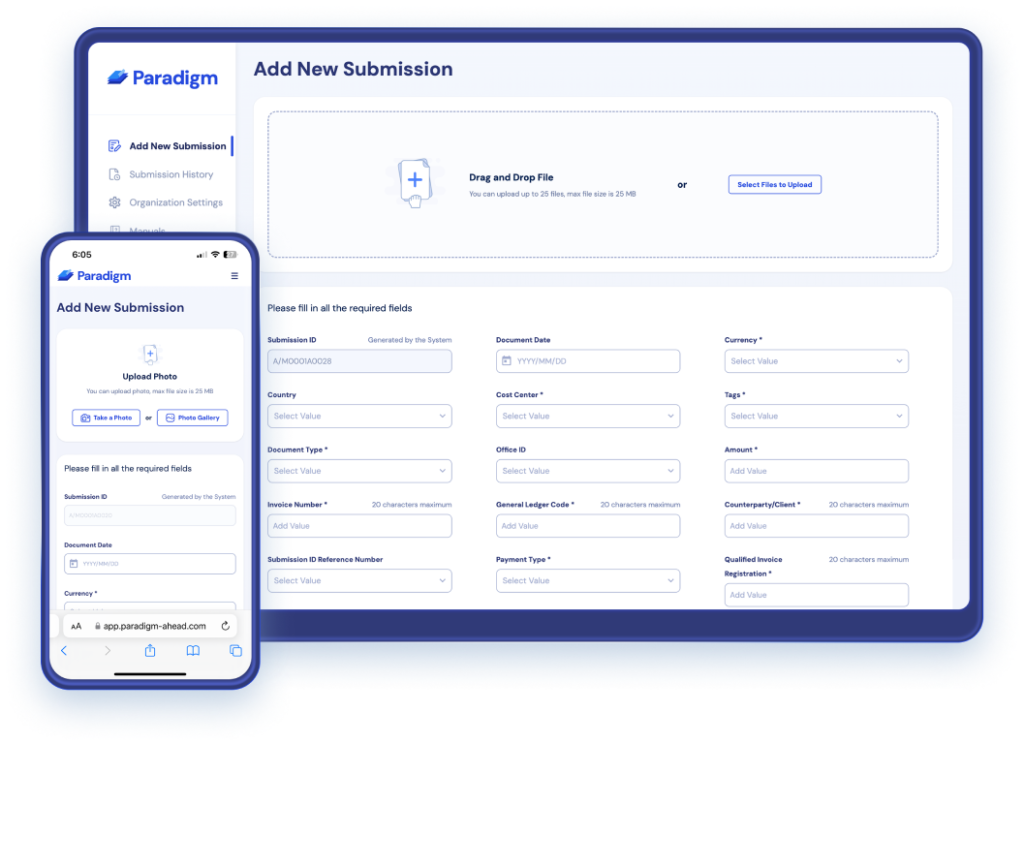

USER-FRIENDLY

No technical skills required, start organizing your business immediately

Effortlessly upload and organize your documents by dragging and dropping, adding details, and submitting for secure storage. Alternatively, capture document images via mobile, upload, and complete your details at your convenience, ensuring full compliance.

BILINGUAL

A truly bilingual SAAS app in English and Japanese

Paradigm supports multiple languages, allowing you to work effortlessly in your preferred language. Reports are automatically generated in your chosen language, no matter the original input.

SECURE

Your Data is fully encrypted for exclusive, secure access

With secure sign-on, two-factor authentication, and per-customer file encryption, Paradigm ensures the highest level of protection for storing and accessing your sensitive documents. As a JIIMA-certified provider, we adhere to the industry’s strictest data security and privacy standards, offering unparalleled peace of mind.

What sets us apart?

Paradigm stands out by offering a seamless, compliance-driven Document Management System tailored for finance and accounting teams. Unlike generic tools, it is designed to simplify complex workflows while ensuring regulatory adherence.

With an intuitive interface, Paradigm enhances efficiency without disrupting existing processes.

Intuitive & Efficient

A user-friendly interface streamlines complex workflows, improving efficiency without disrupting existing processes.

Seamless Adoption

Quick implementation ensures your team can start benefiting from Paradigm immediately with minimal disruption.

Tailored for Finance Teams

Unlike generic tools, Paradigm is designed specifically for finance and accounting professionals, addressing their unique challenges.

Compliance-Driven Approach

JIIMA Certified, Paradigm is built with regulatory adherence in mind, reducing compliance risks and ensuring audit readiness.

Any questions?

Who is Paradigm meant for?

Paradigm is meant for any business that wants to store scanned copies of financial and tax-related documentation digitally in place of paper originals. This includes receipts, invoices, quotes and estimates, or anything else that could be used for tax and audit purposes. Beyond scanned copies, Paradigm will also timestamp and store almost any other type of file securely in the cloud, offering unparalleled transparency and access without compromising security.

What does Paradigm do that keeping digital copies of files won’t?

Starting October 2023, Japan officially commenced its mandatory ‘invoice system’. Under this system, any digital invoice/receipt that was originally generated in digital form must also be stored in digital form. It is no longer compliant to simply print out digital files on paper to store in physical form. As digital files can be easily modified, regulations state that they must be kept only where such modification is technically impossible, such as inside Paradigm.

How secure is Paradigm?

Which languages and regions do you support?

How can we be sure that Paradigm is fully compliant with tax regulations?

Can we verify that files are stored and timestamped appropriately in case we get audited?

All files placed in Paradigm have a log of when they are timestamped. Once a file has been timestamped, its validity can be verified for up to 10 years from the date of the timestamp. This is much longer than tax authorities require businesses to retain records in Japan.